Two years into the pandemic, owners of small and medium-sized enterprises (SME) in the Philippines are optimistic about future economic and business growth prospects and plan to expand this year. However, many highlight a gap between how well protected they are and the risks they currently face.

These were among the findings in the Sun Life Business Growth and Resilience Index, which was created to better understand how confident business owners feel about their growth prospects and how resilient their business is in this highly uncertain environment.

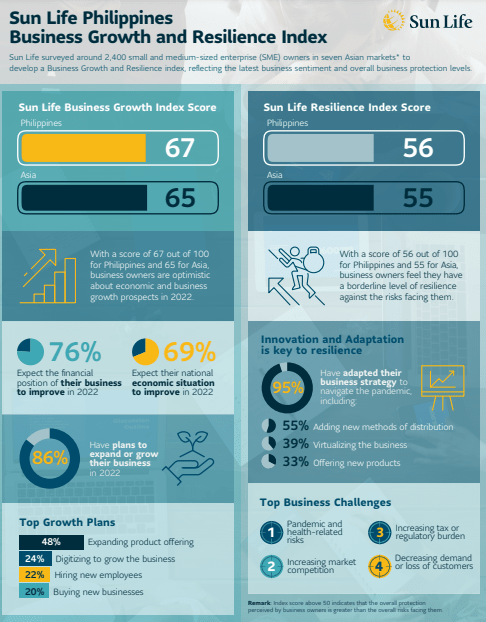

The index is based on a Sun Life survey of around 2,400 SME business owners in seven Asian markets: Hong Kong, India, Indonesia, Malaysia, Philippines (338), Singapore and Vietnam in late 2021. In the Philippines, the following sentiments surfaced:

• 76% expect the financial position of their business to improve in 2022 and 69% expect their national economic situation to improve.

• 86% have plans to expand or grow their business in 2022, with the top plans being to expand their product offering (48%), digitalizing to grow the business (24%), hiring new employees (22%), and buy new businesses (20%).

• 49% of respondents reported that the pandemic has had a negative impact on their business. Meanwhile, 15% said their business fared a lot better in the pandemic. • 95% had adapted their business strategy to navigate the pandemic, including adding new methods of distribution (55%), virtualizing the business (39%) and offering new products (33%), allowing them to capture new opportunities in a rapidly changing environment. • Pandemic and health-related risks, increasing market competition, and increasing tax or regulatory burdens are the top three risks facing SMEs.

Growth Index shows optimism for the future

The Sun Life Business Growth Index analyzes the sentiment of business owners toward the general economic situation, and their financial position and growth plans in 2022. It found Filipino business owners are optimistic about growth prospects in 2022, with a score of 67 out of 100, compared with 65 for Asia overall.

Industries including mining (92), electronics (74) and manpower and security services (72) are highlighted as especially positive.

“Considering the many challenges they’ve had to face in this pandemic, it’s great to see business owners looking to the future with hope,” Sun Life of Canada (Philippines), Inc. President Alex Narciso said. “They likewise acknowledge that they are vulnerable to certain risks as they strive to move forward. Knowing this will help them plan their next steps properly.”

Resilience Index shows resilience is borderline

The Sun Life Resilience Index is based on business owners’ perceptions of the severity of 15 business risks and their preparedness for these. It found Filipino business owners feel they have a borderline level of resilience with a score of 56 out of 100, compared with 55 for Asia overall.

According to the survey, pandemic and health-related risks are the most severe challenge for Filipino business owners. However, less than half of respondents were using risk mitigation tools to build resilience to health risks. Only 43% of respondents have personal health and accident insurance, 31% had employee health and accident insurance, and just 10% had key man insurance in place.

“Health risk protection remains a gap. Addressing this would lead to greater resilience, security, and ultimately, peace of mind,” Narciso said. “Sun Life can be their partner in this pursuit with our Sun Future Proof program.”

Addressing gaps with the help of Sun Future Proof

Designed especially for business owners, Sun Future Proof is a two-pronged program that brings together financial education and financial solutions.

“This combination can help build greater resilience,” Narciso said. “It will help them navigate the uncertain environment, achieve their growth ambitions, and set the stage for their business’ brighter future.”

Those interested to know more about the Sun Future Proof program are encouraged to talk to their Sun Life advisor or connect with one via https://bit.ly/advisormatch.

About Sun Life

Sun Life is a leading international financial services organization providing insurance, wealth and asset management solutions to individual and corporate Clients. Sun Life has operations in a number of markets worldwide, including Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and Bermuda. As of December 31, 2021, Sun Life had total assets under management of $1.44 trillion. For more information, please visit http://www.sunlife.com.

Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges under the ticker symbol SLF.